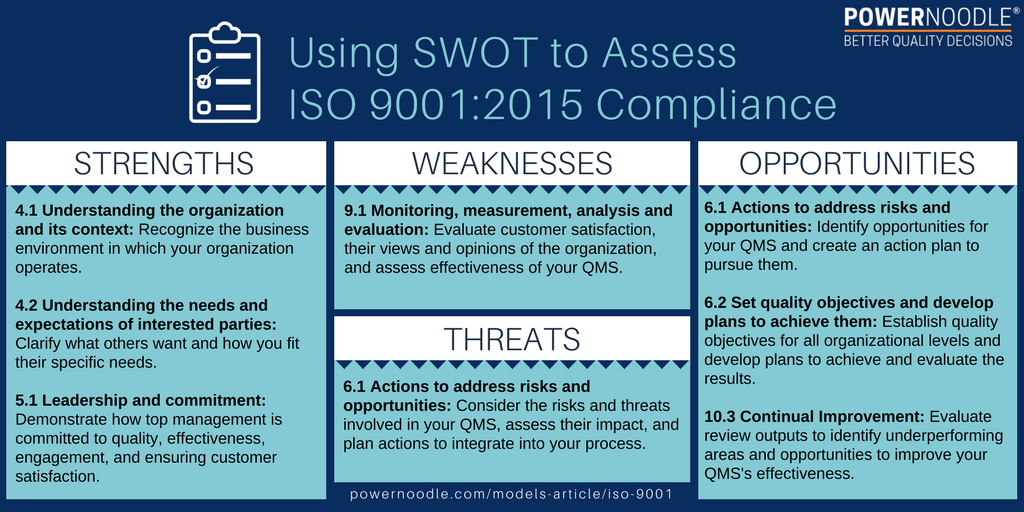

ISO 9001 Quality Management Systems Are Second To None

ISO 9001 entails the production of a documented QM process describing the policies and operations of a firm.

This generates an exact explanation of the business organization as well as guidance on the “best process” adopted to consistently fulfill buyer needs.

An enterprise will definitely profit from building an excellent QM system. The key element of a quality enterprise is the principle of the consumer and also organisation working together for their mutual benefit. For this to be beneficial, the customer-supplier user interfaces need to reach within and outside of the operation, outside the present customers and vendors.

A quality management system is a series of operational processes to direct and control an enterprise in order to regularly strengthen the effectiveness and efficiency of its operation.

Such processes interact and are affected by involvement in the process, so the identification and examination of every one in detail will certainly not automatically bring about an understanding of the process as a whole.

ISO 9001 Is The Ultimate Quality Management System Standard

An excellent quality system should be a vital instrument designed to achieve company objectives and must possess, at its core, a procedural solution with each procedure converting one or more inputs to produce an output that’s valuable to the consumer.

At the same time, much more in-depth work guidance and methods could be established in order to assist with essential company processes. That is especially important as soon as it’s necessary to tightly designate particular job delivery processes.

Nowadays, most enterprises use profession ISO 9001 consultants to establish their quality systems and arrange independent third party certification confirming that these systems meet the ISO 9001 standard.

Most organisations will have key enterprise processes that determine those routines that immediately create “value added” to the product and services for the buying customer and also support procedures that are called for to preserve the productivity of the key procedures.

As with every one of parts of the ISO 9001 standard, it specifies the definitive criteria required for a professional quality management system.

Then, it is the responsibility of the enterprise to determine which is the best solution to fulfill the business’s needs. A documented quality system should usually include a range of stages of documentation.

ISO 9001 Consultants Smooth The Way To Accreditation

A quality reference book generally includes short descriptions going over the company’s policy regarding the demands of the ISO 9001 requirement’s different sections. Such a quality manual is incorporated in third party certification to ISO 9001 complete with documents dealing with each and every section of the standard. As a result, the quality guide is a vital document that ISO 9001 consulting firms utilise which outlines the nature of the company and also its plans, functions and methods.

The methods and the ideal way of developing them to achieve the corporation’s goals are usually known as processes. In depth papers that deliver details of the systems and the manner in which they’re conducted are usually called job directions.

Papers cover the things completed whilst carrying out the process, creating a way of interaction and a file of results. There really are no criteria for the generation of quality system reports. Conformity to ISO standards ought to be located in the documented TQM system and not exclusively in the quality manual. Organisations should take care never to log every small detail of their procedures because it is important to produce a QM system that is user-friendly.

If very in-depth documents are created they may well be exceptionally large as well as challenging for employees to employ and locate the relevant information that they need to have for a specific facet of their work.

Flip Video Production Is Still Alive!

If you ever need to produce a video that is cheap to produce but looks nicely presented, there are alternatives to traditional expensive video productions.

If you ever need to produce a video that is cheap to produce but looks nicely presented, there are alternatives to traditional expensive video productions.

For the type of quick, cheap and cheerful web video production companies look for, then one solution to their filming needs could be a flip video camera which could be just the ticket.

Whether their need is for video film book reviews, employee training or various types of marketing, a flip video solution would be a great way to craft an attractive video with little or no technical ability required without hassle and best of all, at a very low price!!

With a flip camera you can do filming in an office, at a sports event, on the street, in factory or even in a well light living room.

You can of course, use the camera in a normal hand held mode but you can get a near professional result if you obtain a few additional items of equipment.

This will involve the following:

1. A flip type camera eg Kodak Playsport, Samsung HMX-P300, Apple iPod Touch, Sony Bloggie Touch. You can attach remote microphones to these devices and by using SD card easily transfer the recordings to a computer for editing.

2. Where extensive location video filming is involved, it is advisable to have spare batteries and memory cards as auxiliary support for the camera as well.

3. An inexpensive tripod is ideal for video producers which maintains the camera in a level position with the kind of stability required to obtain a smooth filming production. You can get tripods which sit on desk or stand upright to capture a better depth of field.

4. A 4 piece lighting system is perfect for indoor filming where you need to light the subject from the front, back and sides to avoid shadows.

5. An audio microphone to replace the device’s inboard microphone will also enable excellent sound recording and avoid echoes that you can get by using the inboard recorder in an empty internal space.

6. Video editing software like Adobe Premiere Elements 12, CyberLink PowerDirector 12 or Sony Movie Studio 13.

Finally, it is also a good idea to prepare for your filming efforts by developing your skills using the many tutorials on You Tube. Using a professionally produced series of tutorials will help you to set up and use the camera properly, get the lighting right, deal with audio, utilise different filming techniques and thereafter use clever editing to produce the perfect end result.

The you can upload them to any of the popular web based video platforms like You Tube, Vimeo, Hulu, Facebook, Vevo and most importantly of all your own website.

Happy filming!

How To Do An Effective And Efficient Financial Audit

How To Do An Effective And Efficient Financial Audit

Every business organization needs financial audit, and this is true across borders. The financial audit may be a statutory requirement of a particular state or simply a compliance imposed by management of a company or conglomerate.

Normally, the financial audit could be performed only by professional accountants and qualified auditors, and that the auditors express opinion as to the fairness of the preparation and presentation of the financial statements. It may sound with less difficulty but nevertheless, financial audit entails a lot of things to consider.

An Accountant Normally Conducts Financial Audits

First and foremost, it is crucial for an accountant who will act as an auditor, to understand the business or organization they are going to audit. And this accountant must conduct a detailed examination of the financial reports of a particular company without even understanding its business, operations, processes and the like.

Moreover, every organization is unique, thus, every business has different processes and operations that every accountant must take into account. With this in mind the accountant Preston businesses normally find that they need to come up with audit programs and approaches that are fitting and appropriate with the line of business under financial scrutiny.

There are about 4 phases in a financial audit namely, planning, strategy and risk assessment, execution of substantive procedures and finally, conclusion and reporting. The planning stage includes the determination of audit scope, understanding service requirements and establishment of team members who shall conduct the audit.

It is important to note that the auditors must be independent in mind and appearance at all times, and that they should not have any financial or non-financial interest with the company under audit. Needless to emphasize, the auditors must be independent with the companies being audited and examined and follow correct audit procedures. In addition to that, the auditors need to understand the entity-level controls of a company. The controls are defined as the means or methods implemented by the management to prevent employee fraud and the equivalent.

The auditors need to assess the effectiveness of the controls in place and whether they are functioning effectively as intended by the management. If the controls are deemed ineffective, then the auditors should not rely on the controls, which means that extensive substantive procedures must be carried out. These are the basic steps to be followed in the planning stage.

Under strategy and risk assessment phase, the auditors are expected to perform understanding and walk-throughs of significant processes and classes of transactions such as purchasing, cash receipts and disbursements, sales and/or revenue and many more. The purpose of the walk-through is to assess and confirm the auditors’ understanding of the business and processes and whether the established processes and policies are being accordingly followed by the employees and process owners.

The most crucial part of this phase is to use one of a modern audit management system which are now available to ascertain whether the procedures and transactions (purchases, sales, cash receipts and disbursements) are properly accounted for, as the recording of these transactions are critical in arriving with a fairly presented financial statements.

The execution phase is the most imperative part of the financial audit, as the auditors shall perform various examinations and checking of different accounts and balances in the financial reports/statements and normally, it is in this phase that the fairness of the financial information is assessed. The examination would entail using inspection software to check supports and evidences such as inspecting bank accounts of the company, bank reconciliations, performing cash counts, sending confirmations to the company’s suppliers and customers whether payable and receivable balances are properly reflected in the financial statements.

Furthermore, the auditor would perform inventory count and other testing approaches including financial analyses through the use of ratios and the like. Actually, there are a lot of things to perform under execution phase, nevertheless regardless of the approach, the execution phase is all about examining corroborating evidences that would support the transactions reflected in the financial reports of a company.

Finally, after performing the execution phase, the auditor would summarize the findings and if any, the material financial misstatements that should warrant adjustments in the company’s financial statements to achieve a fair presentation of the aforementioned report.

After which, the auditor would opine on the fairness of the financial statements and consider providing suggestions for recommendations to the management on how to better perform the accounting of its transactions.

See also – http://en.wikipedia.org/wiki/Financial_audit